New Bruin Budget Model FAQ

-

1.1 What is the new Bruin Budget Model (BBM)?

The Bruin Budget Model (BBM) is the main component of a new system for establishing annual and multi-year budgets for academic and administrative organizations at UCLA. It is a hybrid of commonly used budget models since it utilizes activity-based, historical/incremental, and priorities-based factors in order to determine budget allocations. While the model is informed by the best practices of peer organizations, notably a model used at the University of Michigan for the past 25 years, it has been tailored and designed specifically to support academic excellence at UCLA.

1.2 Why is UCLA transitioning to a new budget model?

The budget context for UCLA and peer public universities has changed. For UCLA, the levers that enabled budget growth in the past decade are no longer available. We expect the future to have low revenue growth with relatively flat enrollment, low/modest tuition increases, unpredictable State support, and a cap on nonresident enrollment.

UCLA currently uses an incremental budget model, which works well during periods of high revenue growth. High revenue growth makes it possible to centrally fund annual inflationary increases for all units as well as invest in high priority needs such as faculty retention, student aid, diversity initiatives, research, deferred maintenance and cyber-security, to name a few.

However, incremental models do not perform well during low revenue growth periods. Our current model is primarily incremental and does not provide transparent incentives for units to pursue revenue growth opportunities, to find efficiencies, or to exhibit strong expense management.

In brief, the status quo is no longer suitable for UCLA.

1.3 Is the new model RCM?

Responsibility Center Management (RCM) has been around for 50 years and is defined by extreme decentralization, with Schools operating within their own revenue generation. The national trend shows a move toward hybrid models with partial decentralization. The Bruin Budget Model (BBM) is not RCM. It is a hybrid.

1.4 Is the new Bruin Budget Model similar to the UC-wide budget model?

Yes. With the adoption of “funding streams” in 2011-12, UC effectively adopted a similar hybrid model for all of UC. Tuition is kept by the local campuses, State funding is held centrally and allocated by UC-decided metrics, certain State funds are allocated directly to support research programs, and the central services of the Office of the President are funded by a simple assessment.

At a recent Regents meeting, UCOP reported that the change in models was a success in that it does a better job of aligning revenue with workload and providing incentives for the campuses to be innovative and efficient. Since the adoption of funding streams, the academic rankings of UC campuses have risen steadily.

1.5 Why will the new model work better than the legacy incremental model?

The new UCLA budget model is designed as a hybrid system that includes components of activity-based, historical/incremental, and priorities-based models to determine budget allocations. We believe this system will perform better than the legacy incremental model in four areas:

- Better align resources with activity cost drivers (such as student credit hours);

- Create transparent incentives and support for units to be entrepreneurial where there is opportunity;

- Restore and establish a stronger central investment fund for the EVCP to make strategic investments (priorities-based) in academic and research programs; and

- Cap growth rates in non-academic budgets while replacing the complex internal recharge system that funds central budgets today.

1.6 How will we know the new model is working better and supporting academic excellence?

UCLA’s Office of Academic Planning and Budget (APB) is working with the Senate’s Council of Planning and Budget to design an oversight and assessment plan. While not final, example metrics to assess could include student/faculty ratios, total investment in faculty, time-to-degree, course duplication, and course size. This plan will be shared with all campus stakeholders for input. To support the evaluation process, APB will be creating a new set of dashboards available to the entire UCLA community that will present all of the key data associated with the model and UCLA’s budgets. There will be an unprecedented level of transparency on UCLA’s budget that has not existed previously but is appropriate for the nation’s #1 public research university.

If the assessments of the new model shows that it is not working or can be improved, there is a commitment by senior leadership to make adjustments.

1.7 How is revenue allocated under the new budget model?

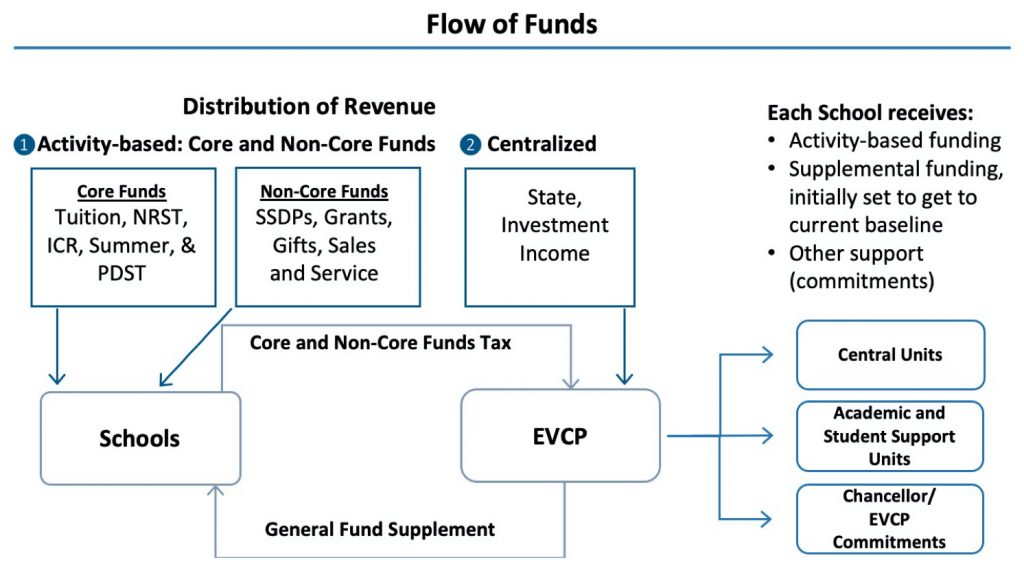

Academic units will have two components to their annual funding:

- An activity-based component that is determined by the School/Divisions’ own activities such as teaching (tuition) and research (indirect cost recovery); and

- A supplemental fund provided by the center to create stability, help fund inflationary costs, and to invest in shared priorities. The supplemental fund is initially set to an amount to get each School to today’s General Fund level. This means that the new model will influence future changes in budgets, not current funding levels.

A central fund will be established from State funding, investment income, and a campus assessment (aka “tax”) that largely replaces recharges for campus-wide central unit services and the UCOP tax. The non-core funds tax has been set equal to what campus units pay today in January 2021 3 recharges. Uses of the central fund will be decided by the EVCP and include supplemental funding to academic units, funding to non-academic units, and investments in campus priorities.

Non-School units will be funded primarily from an annual allocation from the central fund. Campus recharges will be limited to “premium services” that will be identified in service-level agreements that organizations will share with the campus (see “Flow of Funds” graphic below).

1.8 Will budgets change July 1, 2022 when we go live with the Bruin Budget Model (BBM)?

All units will maintain their current baseline (permanent) budget on day one of the new model as the model is designed to be budget neutral on 7/1/22. Similarly, the tax assessments have been set to be equal to what organizations are paying today in assessments and recharges. So, there will be no change in net funding when we go live with the new model.

Going forward, the new model will better align future years’ incremental allocations to activity trends such as increases in teaching student credit hours, new graduate programs and enrollments, increased research grants, and indirect cost recovery.

1.9 Are the budget reductions that are being planned a result of the new budget model?

The budget reductions assigned to administrative organizations and academic departments are the result of the global pandemic and recession – not the new budget model.

Campus funding has been impacted by revenue losses in State funding; health system and auxiliary revenue; flat enrollments and deferred tuition increases; and declines in investment income. Other impacts include non-reimbursed expenditure increases such as those for faculty merits, represented staff, pension and health, and COVID-related expenses. We have translated this financial loss into a planning scenario that will be implemented over three to four years. There is still a great amount of uncertainty and the final cuts we implement will be informed by actual permanent financial impact.

-

What was the process to develop the new Bruin Budget Model?

2.1 How much consultation was there in developing a new model?

- APB was charged by our EVCP in fall 2017 to begin work on a new budget model for UCLA due to the recognition that our current incremental model is unsustainable given the realities of our general funds revenue outlook

- An internal committee was formed comprised of 4 faculty members, including a former senate chair and 2 members of CPB, 3 assistant deans, and a representative from the administration

- The committee’s early work was informed by consultations with several peer institutions and eventually deeper engagement with the University of Michigan

- The 2017-18 work was presented and discussed at a leadership retreat in February 2018 with 70 participants (deans, assistant deans, vps, vcs, and senate members)

- Since then, APB has participated in more than 200 meetings, and consultations on the new model with ~2,000 participants, and further consultation is on-going

- Meetings conducted in the development and refinement of the Bruin Budget Model:

- Multiple appearances at senate committee meetings: council of planning and budget, undergraduate council, executive board, college FEC, committee on interdisciplinary activities, legislative assembly

- Worked closely over two years with the senate CPB subcommittees on the new budget model

- Consulted with William G. Ouchi, UCLA Anderson Distinguished Professor of Management and Organizations, Sanford and Betty Sigoloff Chair in Corporate Renewal

- Ran senate-hosted open faculty invite sessions on important budget matters in 2018, 2019, and 2020

- Held sessions with deans, assistant deans, and school leadership between 2018 and 2021

- Conducted spring 2020 budget model sessions with department chairs, joined by our EVCP, VC/CFO and VC APO

- Have had multiple sessions with Institute of American Cultures directors, International Institute directors, and Organized Research Unit directors

- APB staff 1:1 sessions with assistant deans and administrative CFOs/directors

- Current dialog sessions with each School that includes the dean, assistant dean, department chairs, and school FEC representatives, joined by our VC/CFO

- Spring town hall for all faculty – to be scheduled

2.2 What changes and adjustments were made as a result of these consultations?

- Changes made to the model this year as a result of consultations with deans, administrators, faculty and staff:

- old model will be run in parallel to the BBM for the first two years after going live

- SSDPs to be classified in the lower 5% tax rule to maximize the department financial benefit

- gift and endowment funds to be excluded from the expenditures tax

- Based on feedback, we are currently looking at options to give departments credit for faculty teaching outside of their home department

2.3 How will the model be implemented?

- The plan is to phase-in the model in over 4 years, then assess, and adjust.

- Examples of the phase-in include:

- Starting point:

- All organizations and departments start with the same funding as today

- While the target non-core funds tax is 5%, we are starting with the tax rate to be equivalent to what organizations are paying today in recharges (less than 5%)

- We will phase in the replacement of certain recharges over two years to create time for central units to better define and share service levels covered by tax funding

- We have built a budget scenario where the center will be substantially funding mandatory cost increases while we wait for cohort tuition to help boost our general funds

- APB has been working closely with the CPB subcommittee to create a metrics dashboard to monitor academic quality and collaboration so that we can respond quickly if there is an issue – this includes monitoring for and addressing any issues related to competition for student credit hours/enrollments

- There will be a shared-governance assessment of the model before changes are made after the initial 4 years

- Starting point:

2.4 What is the process going forward?

- As part of converting to a new model, we are adding transparency to the budget

- APB has shared interactive Excel simulations showing the details of the proposed budget model funding down to the school level. This enables, for the first time, real scenario planning by the schools where they can see estimated funding levels over the next 4-years based on their strategic plans

- APB plans to publish annual reports on school-level and department-level changes in budget which is a best practice that we like from UM

- There will be a shared-governance assessment of the model before changes are made after the initial 4 years

-

3.1 What is the purpose of the General Fund Supplement in the new model?

The General Fund Supplement will serve multiple purposes. When the model is implemented on 7/1/22, the supplement amount provides stability by making units’ funding whole as compared to today. In the future, the change in the supplement will provide support for inflationary increases such as faculty merits, adjustments for cases where the activity metrics do not correlate to funding need, and will allow for priorities-based investments by the EVCP. It will be reviewed each year as part of the annual budget process. The model has intentionally been designed so that each organization receives some of their funding from the General Fund Supplement.

3.2 “Baseline funding” is equivalent to the starting point of the new model. For units that have an unfavorable current budget situation, does the new budget model take that unfavorable situation as a given? Are we assessing and analyzing the fairness of the “baseline”?

Selecting a moment in time when everyone feels their baseline is appropriately funded is virtually impossible. One way we account for this is by using a multi-year average for credit hours, so that the impact of one irregular year is minimized. In addition, if the faculty budgets for an organization are disadvantaged by switching at 6/30/22, we will work with units to make fair adjustments. APB has introduced metrics into the annual budget process and continues to advise on the fairness of the baseline. The EVCP is initially focused on a few specific situations where there are extreme outlier ratios.

3.3 If units increase activity revenue, the simulation1 shows the General Fund Supplement remaining stable. Is the intention that the supplement will decrease or be modified with increased revenue?

No, that is not the intention. The model is designed to create local incentives to grow activity revenue and to find efficiencies where there are opportunities to do so. It would be counter to the incentive to reduce supplement funding as units are successful, and the intent is for the revenue growth and/or savings to be reinvested by the Schools. The amount of the supplement will be determined annually by the EVCP through the budget process. If there are any material changes to the amount, it will likely be phased in over multiple years to create stability and allow for planning.

3.4 For the priorities-based allocations, what are the priorities and how will we learn about them?

Each budget cycle, there will be a letter from the EVCP that will state the campus priorities. In the past, this has included investments in teaching to support enrollment growth; student success initiatives and financial aid; diversity initiatives; deferred maintenance and seismic projects; research programs; and faculty recruitment and retention. We will now also have strategic plans at the campus level and the organizational level that identify priorities and inform investments.

*APB has distributed Bruin Budget Model simulations to each Dean

3.5 What processes will be used to allocate the pool of funds held centrally by the EVCP? Will UCLA ensure that there is transparency, predictability, and accountability embedded in that process?

The annual budget process will be used to review the EVCP’s General Fund Supplement contribution to a unit’s budget as well as any requests for funding for strategic initiatives. As part of this discussion, we will look at metrics and trends and consider the organization’s strategic plan. We plan to continue increasing campus-wide visibility into the process and also into the metrics and dashboards used to evaluate units’ success under the model.

-

4.1 What happens to the General Fund “permanent” budget and how will the model affect Department budgets?

Today, the permanent budget ensures there is enough annual funding to support approved staffing rosters. The permanent budget will continue to be utilized to balance and manage staffing rosters.

Under the Bruin Budget Model (BBM), School-level budgets are determined by considering School-level metrics combined with a central supplemental allocation that will be stable and predictable. Because the new budget model is designed to be budget neutral in year 1, Department General Fund permanent budgets should not change as a result of the transition to a new budget model. Going forward, as School funding levels change, Deans will determine how to allocate changes among their Departments. We expect this will be informed by new strategic plans that have been developed by each School.

4.2 Are there any other changes that affect Department budgets within the Schools?

As noted above, Departments’ permanent budgets within the Schools will not change when the model goes live. Permanent budgets will remain in place, and any approved temporary Chancellorial commitments will continue to be honored. In addition, units can continue to request additional investment funds from the EVCP during the annual budget process if there is a campus strategic need for additional investment. If Schools receive additional funding in future years of the model, it is up to the Dean to decide how to allocate those funds among their Departments.

4.3 Why not just run the model at the Department level to inform Department budgets?

Budget models such as the one we are implementing are not typically run at the Department level. The reasons for this include: (1) there is a wide range of instructional cost structures at the Department level, which is appropriate because different academic disciplines require different class sizes, classroom models, student faculty ratios, and research time spent by faculty; and (2) the model is designed to give the Dean’s office flexibility to implement the appropriate budget allocations for their School, and that should not be done centrally.

APB will support the process of evaluating Department trends by creating dashboards that consider Departments’ metrics and trends and by monitoring changes in funding for all units. Regardless, by continuing the permanent budget for staffing rosters, there should be a great deal of stability in Department budgets as over 90% of academic Department General Funds are spent on salaries and benefits.

-

5.1 How are faculty salaries funded in the new budget model?

Salary increases, including faculty increases, continue to be funded by General Fund revenues. In the new model, revenue associated with enrollments and tuition increases are part of the base funding for Schools, and revenue from State sources are collected centrally and then allocated to units. Both components contribute to the budgets for faculty compensation. For the current period (no tuition increases and State cuts), faculty cost increases will be funded centrally; this has been incorporated into the budget scenario work. In the future, APB will continue to ensure that faculty compensation is adequately funded for each School, each budget year. This means that APB will continue to run the same faculty funding model with the difference being that it will be managed via separate accounts at the School/Division level versus one account at the Chancellor level.

5.2 How will the faculty salary pool, merits, and adjustments be distributed to the Schools?

Each year, Schools will establish a faculty budget that utilizes the formula that APB has developed and has been applying to campus budgets for the past decade. The formula estimates the net cost of merits, range adjustments, upgrades associated with new hires, and attrition associated with retirements and departures. The starting point will be the same budget planning percentages that have been utilized in the past. School-based factors such as strategic plans and specifically approved faculty search plans will also be incorporated. The budget process and new multi-year budgeting will ensure the resources are available for faculty salary adjustments and search plans. In cases where more central support is needed, a budget request is submitted.

As noted above, it is anticipated and built in that during the first four years of the model, additional central support will be needed. In the future, when cohort tuition takes hold and state support is more consistent, Schools should have sufficient resources from the activity-based and centrally-provided funding to cover faculty salaries. It is important to note, however, that under any budget model, including the current model, if to the campus is unable to maintain consistent tuition or State funding increases, a new approach will have to be designed

5.3 How will the planned centralization of Academic Personnel in some areas affect the new budget model?

The new budget model does not assume savings or new costs associated with any of the Hub and Spoke plans that are being discussed and developed.

-

6.1 How does the model allocate tuition based on teaching?

For Schools that teach undergraduate students, the model allocates funding for both teaching and majors by using two drivers – undergraduate major enrollment headcount and actual undergraduate credit hours taught. A three-year average, weighted for the most recent year, is used for each of these drivers in order to smooth out any irregularities in a given year. The funding for undergraduate major enrollment is weighted at 20% while the funding for undergraduate teaching is weighted at 80%. This weighting is designed to allocate funding to areas with higher expenditures on undergraduate teaching. The tuition per student credit hour is a centrally calculated figure and includes the nonresident supplemental fees collected each year.

For Schools that teach Graduate students, funding is allocated based on enrollment, using twoyear averages. Graduate tuition less the UCOP mandated return-to-aid component is allocated to the Schools for each student enrolled in their programs. Additionally, any applicable NonResident Supplemental Tuition (NRST) is also allocated for each non-resident student. Under the new model, graduate tuition, net of aid, flows directly to the Schools to support graduate teaching. Professional Degree Supplemental Tuition (PDST) and Self-Supporting Degree Program (SSDP) fees will continue to flow directly to the Schools as they do now.

6.2 Does the model unintentionally incent Departments to compete for undergraduate teaching?

For undergraduate teaching, the goal of the new model is to properly align funding with resource needs, not to increase undergraduate enrollment or incent competition over existing undergraduates. We have completed a decade of substantial enrollment growth in undergraduates, and decisions to add enrollment require EVCP approval. The incentive portion of the model is designed to promote growth in other areas where there are opportunities (summer, SSDPs, research, new ventures). Undergraduate academic program decisions should continue to be based on academic quality and student outcomes. We are working with the Academic Senate to develop key metrics to monitor to ensure that UCLA maintains the high quality of its academic programs. The EVCP will monitor metrics to make sure that shifts in undergraduate credit hours are strategic and make sense; actions adverse to academic quality and student success could impact a unit’s EVCP supplemental allocation.

6.3 How will new majors and new minors be funded in this model?

New undergraduate degree programs, if approved by the Academic Senate and the EVCP, will be funded by the activity-based per-credit hour funding. APB has reviewed recent new majors, and the new model formulas result in comparable funding to the legacy system of EVCP commitments. Requests for start-up support can be made through the annual budget process

6.4 This is an extraordinarily complex and uncertain moment for enrollment, especially at the graduate student and SSDP level. How is that going to be accounted for in the model?

Using averages should help provide stability. If there are long-term declines in enrollment, they should correlate with the need for fewer resources.

6.5 What are the non-tuition activity-based components of the model?

There are several:

Indirect cost recovery (ICR): The new budget model allocates a higher percentage of indirect cost recovery to the earning Schools and units than today’s legacy model. To be consistent with the principle of keeping the model equivalent to today’s funding, there is a grandfathered fixed amount of ICR funds that will be retained to support central infrastructure. Growth in ICR funds will be distributed 90% to the earning organization and 10% to the Vice Chancellor for Research to support campus-wide research infrastructure needs. (Please see additional information on ICR in “Taxes & Recharges” section.)

Summer session revenue: The new budget model simplifies and adds transparency to the distribution of summer session revenues. The total fees collected will be sent to the earning Department. Net of taxes (see “Taxes & Recharges” section), this results in an approximate 10% increase in summer revenues to the Schools.

Other core funds (PDST, student fees) and non-core funds (self-supporting degree funds; gifts and endowments; patent income; sales and service; and other sources): In today’s model, these funds are already directly recorded by the earning organization, and there is no change in the new model.

-

7.1 What taxes will Organizations need to pay to the center?

There will be 2 types of taxes that Organization will need to pay:

- 25% tax on Tuition, ICR and Summer Tuition Funds: In the new model, these funds are mostly allocated to academic units, so they will pay a 25% tax assessment. The supplement ensures that the impact of the tax is budget neutral on day one of the model. Note – PDST is not assessed this tax.

- 5% tax on non-core funds:

- This tax will replace central administrative fee recharges along with the OP Tax. Campus administrative fees (CAFs) are currently assessed on specific funds that are listed on an eligible recharge list. This list primarily includes funds such as S&S and SSDP funds. OP Tax, however, is assessed on whichever funds the School designates.

- The tax rate in the first 5 years of the model will be equal to what the Organization is currently paying for campus administrative fees (CAFs) and the OP Tax that will go away. Funds such sales & services, SSDPs and other source funds are included in this tax. The target rate for this tax after 5 years is set at 5%.

Some of the principles used in designing the tax system include:

- To develop a simpler and more transparent system to fund central units, and to replace today’s costly and complex system of developing numerous recharge rates to pass on costs to internal campus customers;

- To make the system equivalent to today’s funding;

- To improve planning information for organizations; and

- To cap the growth rates of non-academic budgets and keep the tax rate amounts stable for long periods.

7.2 What will be covered under the central services tax? What charges will continue? When does this begin?

On day one of the model, it is expected that many of the current campus recharges and assessments such as campus administrative fees (CAFs), and the funding for the Office of the President and UCPath will be replaced with a simple tax system. This tax replaces the various recharges that fund central units today on campus and puts in place a single tax that is easier to plan for and less cumbersome than the current recharge system. These units are creating Service Level Agreements that describe what is covered by the tax. The 5% expenditures tax will be phased in for the initial four years of the model, during which time units will pay the equivalent percentage they are paying today in campus recharges on these funds. The application of the tax model to UC Health activities is currently under discussion.

There will continue to be “premium” service recharges, and we are working with central service units to identify them. Once finalized, we will provide a list of which services are covered under the tax and which services will remain premium recharges. We will also provide the Service Level Agreements that the central units create as a replacement to the elimination of any recharges.

The elimination of certain recharges begins when the new model goes live. Many of the central service recharges, central administrative fees (CAFs), and the OP assessment will be covered by a tax under the new model.

7.3 Are there any revenues or expenses excluded from the tax assessments?

Yes, there are some exclusions. These include:

- Core Funds – Professional Degree Supplemental Tuition (PDST): There will be no tax assessed on PDST. PDST proposals and rates are approved by the Regents and the allowable expenses are limited to certain categories.

- Non-Core Funds – Gifts and Endowments: There will be no expenditure tax on gifts and endowments during the initial four years of the model. While there are certain recharges and assessments on these funds today, they amount to a small amount of funding contributed to central units. Since we will be grandfathering existing rates anyhow, this zero tax rate creates an incentive for units to spend their gift balances. This will be re-evaluated after the initial four years. The existing gift fee of 6.5% remains unchanged.

- All Funds – Financial Aid and Capital Expenditures: There will be no expenditures tax and a credit for the core funds revenue tax for any expenditures on student financial aid or capital expenditures.

We are also continuing to review all funding sources on campus for any other potential exclusions and will provide a complete list of exclusions once it is final.

7.4 Will grant expenditures be included in the non-core funds expenditures tax?

Yes, grant expenditures are included in the 5% non-core funds expenditure tax. Only grants that earn ICR of at least 25% will be included in the tax calculation. The reason for this is that the ICR returned to organizations is the source to pay the grant expenditure tax – and this payment is subtracted from the ICR’s 25% tax. With the higher percentage of gross ICR allocated to organizations under the new model, even after paying taxes, the academic organizations will still benefit with ~30% higher net returns from their ICR generated. Again, because the starting point is equivalent, this is true on new ICR earned above today’s baseline.

7.5 Will tax rates change?

As described above, one of the principles used to design the tax system under the new budget model is to improve planning information for organizations and hold tax rates stable. For the first four years, non-core expense tax rates will be grandfathered in at the current recharge and assessment levels; after the first four years, we expect to enter a period of 5% non-core tax rates for the foreseeable future. The core funds (tuition, summer, ICR) tax rate on revenues will be set at 25% when the model goes live, and we also expect that to continue. While senior leadership has committed to reviewing the model regularly and making improvements where necessary, we do not anticipate changing the rates in the near term. If it is determined that the tax rates need to be adjusted, this change would be made with input from campus stakeholders and would need to be approved by the VC/CFO and EVCP.

-

8.1 Will the new model require any new year-end procedures such as reconciliation?

The accounting processes required to close a fiscal year will not change under the new model. APB will be maintaining detailed worksheets and each budget year the plan is to publish reports that will show budget support levels and changes in annual funding. If there is strong interest in maintaining legacy model funding estimates for a period of time for comparison purposes, it is possible to do.

8.2 How does the model support interdisciplinary work?

Existing permanent and temporary budgets for interdisciplinary units and projects continue with no impact. Growing collaboration across campus is a priority, and one of the assessment metrics is likely to be total investment in interdisciplinary work. The new model can support this through the built in sharing of activity-based revenue, new investment from the center or Deans’ offices, or possibly through some new incentives that are being developed.

8.3 How was the new budget model developed, and how did we end up with the current design?

Under the direction of our Chancellor, EVCP, and VC/CFO, APB has been leading efforts to design the replacement model to our legacy incremental budget model.

This work started in FY19 and included an internal committee comprised of Senate members and senior finance staff from academic and administrative units. The work was informed by best practice research and direct engagement with peer institutions that have similar models to the one that has been developed. Extended engagement occurred with the University of Michigan (UM) on a model they have been running and refining for the past 25 years. UM was selected because of its academic excellence, research prominence, and the metrics and assessments that they were willing to share on their hybrid model.

Informed by this research, APB then built and tested a prototype specifically customized for UCLA. There has been no consulting firm involvement (or spending) in the development of this model – it is a UCLA product.

8.4 Are you truly taking feedback or is this a done deal?

The goal of the model design is to get to best-in-class financial practices that optimally support UCLA’s mission and fit the campus culture. The initial design is not the final product, and feedback and adjustments will be a continuous process in the early years. We have already incorporated feedback and made changes to create better incentives for developing self-supporting degree programs, spending of gift balances, and extending the plans to run the current and prior model in parallel.

8.5 Will you be running the old model and new model in parallel?

Yes. APB has built a simulation of the model and has used it to run the parallel test for FY19, FY20, and is doing so in FY21. The plan is to go live with the new model in FY22 but to maintain the balances for each organization under the old model during the first year to make it easier to assess.

8.6 With the deficits facing the State, UC, and UCLA, is this right time to change budget models?

Because the model has been designed to do a better job of aligning revenue with instructional workload and to provide incentives in areas of growth opportunity, going live now has the potential to help strengthen our financial position over the next several years. Our campus plans to deal with the deficits remain unchanged. It is also recognized that until we get to consistent revenue growth from modest tuition increases and increments to State funding, more help will be needed from the center in the early years of the new model, and that support has been incorporated.

8.7 Is there anything else to know?

UCLA continues to reach new levels of academic excellence. However, administrative systems have not kept pace with best practices and with changes in our budget context. As we move forward and face the next decade of challenges and opportunities, we must upgrade our internal processes to better support our academic excellence. The Bruin Budget Model (BBM) is an important step towards supporting our shared goals.